Build credit.

For free.1

For free.1

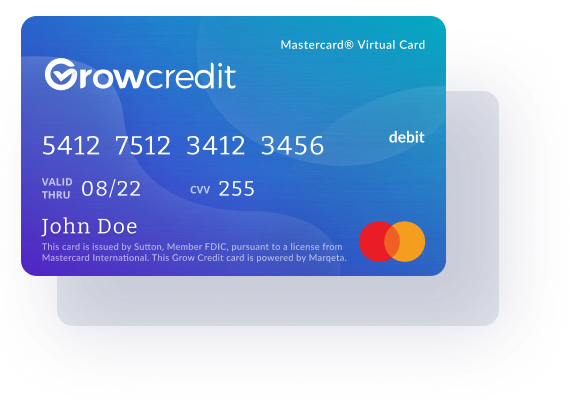

Grow Credit offers a free Mastercard you

can use to pay your subscriptions and

build your credit.

can use to pay your subscriptions and

build your credit.

Featured in the Forbes Fintech 50 as one of America's most innovative startups.

Fintech 50 2022

Fintech 50 2022

"A pretty elegant way to solve a problem that’s a real barrier to entry for a large number of

financial services."

"A useful tool for climbing the ladder and eventually qualifying for a better card."

"The Grow Credit Mastercard is ideal for those with no credit or poor credit."

Get credit for

paying for your

subscriptions

paying for your

subscriptions

We report your payment history to all three major credit bureaus (Equifax, Experian and Transunion) which may help establish or boost your credit score.2

How it works

Get set up with your

Grow Credit account

Grow Credit account

Apply for a Grow Credit interest-free Mastercard and connect your bank account. Signing up is easy.1

Add your

subscriptions

subscriptions

Add subscriptions to your Grow Credit account using our list of 100+ available subscriptions.

Use your new Grow

Credit Mastercard as

your payment method

Credit Mastercard as

your payment method

Add your card number to your new and existing subscription accounts, to be paid consistently with your new Grow Credit Mastercard.

3

Sit back and watch

your credit grow

your credit grow

Your subscriptions are paid with your new card and your payments are made consistently which contributes to a better credit score.

“My Credit score has jumped 20 points in a few months of using Grow, so I'm on an upward trend of credit growth and repair. Easy to set up with my current subscriptions as the virtual credit card makes it seamless.”

Jamie H.

Memberships

Designed for growth, reporting to:

Build Free1

$17

Monthly

Spending Limit

Spending Limit

$204

Annual Limit

Annual Limit

Reported to the bureaus to boost your credit score

ALWAYS FREE

Build & Save

Build Secured

$204

Annual

Limit

Limit

Reported to the bureaus to

boost your credit score

boost your credit score

$17

Monthly

Spending Limit

Spending Limit

Annual Savings

Two month savings when fees are paid annually.

Upgrade eligibility after 6 consecutive months of usage and ontime payments.

Security deposit of $17 required; refundable after 12 months of consecutive ontime payments.

Free financial literacy education

Free access to your Credit score

AS LOW AS

$4.99/mo

$39.99/yr

$39.99/yr

Grow & Save

Grow Membership

$600

Annual

Limit

Limit

Reported to the bureaus to

boost your credit score

boost your credit score

$50

Monthly

Spending Limit

Spending Limit

Annual Savings

Two month savings when fees are paid annually.

Access to premium subscriptions

Access to exclusive subscription discounts from select partners

Free financial literacy education

Free access to your Credit score

AS LOW AS

$6.99/mo

$69.99/yr

$69.99/yr

Accelerate Membership

$1,800

Annual

Limit

Limit

Reported to the bureaus to

boost your credit score

boost your credit score

$150

Monthly

Spending Limit

Spending Limit

Annual Savings

Two month savings when fees are paid annually.

Access to premium subscriptions

Access to exclusive subscription discounts from select partners

Cell phone bill payment

Free financial literacy education

Free access to your Credit score

AS LOW AS

$12.99/mo

$129.99/yr

$129.99/yr

Don’t just take our word for it.

Growing your credit can change your life. Like these people...

- Angeli V.

- Anna S.

- Jonathan W.

- Priscilla K.

- Twyla M.

- William L.

Frequently Asked Questions

What is Grow Credit?

Grow Credit is dedicated to lowering the barrier of entry for millions of Americans who need to establish and build credit by allowing customers to automatically pay for their subscriptions through an interest-free virtual MasterCard. You can use your Grow card to pay for recurring subscription services such as Netflix, Hulu, Amazon Prime, Spotify, and many more. We report your monthly repayments to the three major credit bureaus so you can build your credit repayment history.

How much does Grow Credit cost? Does Grow charge interest?

Grow Credit currently offers four plans. The Build plan is completely free, and there is no obligation to upgrade to a paid account at any time.

The Build Secured plan is an alternative for customers who do not meet the Build underwriting criteria, and it costs $1.99 per month. The Grow membership plan costs $4.99 per month, and the Accelerate plan costs $9.99 per month. Grow and Accelerate memberships provide higher monthly transaction limits, which can have a greater impact on your credit score.

We do not charge interest on any Grow Credit accounts.

The Build Secured plan is an alternative for customers who do not meet the Build underwriting criteria, and it costs $1.99 per month. The Grow membership plan costs $4.99 per month, and the Accelerate plan costs $9.99 per month. Grow and Accelerate memberships provide higher monthly transaction limits, which can have a greater impact on your credit score.

We do not charge interest on any Grow Credit accounts.

How can Grow help me build my credit score?

Using Grow allows you to demonstrate a repayment history to the credit bureaus for the subscription accounts you already have (or you can add new ones), without the cost of high interest rates. By providing a line of credit, Grow helps you build your credit score in several ways:

- Automatically having your balance paid in full every month creates a consistent payment history, which accounts for 35% of your score.

- Grow starts the clock on your average length of credit history, accounting for 15% of your score.

- Grow adds another line of credit to your credit mix, which accounts for 10% of your score.

What do I need to get started? Can I join if I have bad credit or no credit history at all?

You will need the following to begin your credit-building journey with Grow Credit:

- A bank account where you deposit your income

- A valid email address and phone number

- A social security number

- You must be a permanent resident of the United States.

- You must be at least 18 years of age.

Will Grow Credit perform a hard credit inquiry when I apply?

We do not perform a hard credit check or use credit scores as a determining factor when applying for a Grow account. Grow Credit performs a soft credit check when you apply for an account for identification verification purposes only. Your application will not negatively affect your current credit score.

Which credit bureaus does Grow Credit report to?

We report to Equifax, Experian, and TransUnion.

How long will it take for my credit score to be affected?

Normally, you should begin seeing Grow Credit on your credit report 60-90 days after your first payment.

I have a business and want to partner with Grow Credit. Who do I contact?

If you think your business should partner with Grow, please go to our partnerships page and fill out the inquiry form. A representative will respond within 5 business days.

How can I contact support?

You can contact our customer support through the chat box on the bottom right hand corner of this page or by emailing us at behappy@growcredit.com.

“I have terrible credit and it seemed as if no one was willing to help me with the journey of rebuilding until I came across the Growth Credit app.”

James B.

Start building your

credit today!

credit today!

Grow Credit is offered and serviced by Grow Credit, Inc. (“Grow Credit”), and is a combination of a virtual MasterCard provided by Sutton Bank and a loan provided by either Blue Ridge Bank, N.A. or MRV Banks.

Cellular network, messaging, and data rates may apply when using the Grow Credit app and/or website. Contact your carrier for details. All product names, logos, brands, trademarks, and registered trademarks are property of their respective owners. All company, product, and service names used in this website are for identification purposes only. Use of these names, trademarks, and brands does not imply endorsement.

1 Eligibility for the Build Free Plan required. The cost of your credit issued by MRV Banks and accessible by the Sutton Bank Virtual Card is an Annual Percentage Rate of 0.00%, the Finance Charge is $0.00. 12 monthly payments equal to the balance of your Grow Credit account at the end of each calendar month. See your MRV Banks Loan Agreement for more details.

2 Note missed payments may have a negative impact on your credit score.

3 Credit scores and/or score improvements depicted in graphics and testimonials may not necessarily represent your score or reflect actual improvements attributable to use of Grow Credit. Missing or late payments may adversely affect your credit score.